oregon wbf tax rate 2020

OregongovdcbscostPagesindexaspx for current rate notice. The detailed information for Oregon Wbf Assessment Rate 2020 is provided.

Many Struggling Oregon Businesses To See Tax Hike In 2021 Katu

Go online at httpswww.

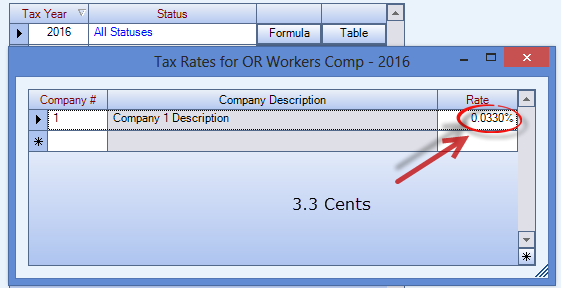

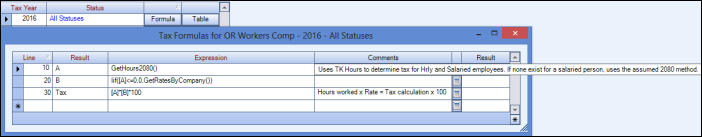

. Help users access the login page while offering essential notes during the login process. The WBF assessment rate which varies from year to year is xxx cents for each hour or partial hour worked. For example The 2017-2018 rate is 28 cents for each hour or partial hour and.

Try it for Free Now. Go to Oregon Wbf 2020 Rate website using the links below. This assessment is calculated based on employees per hour worked.

For 2022 the rate is 22 cents per hour. Ad Access Tax Forms. Tax rate of 475 on the first 7500 of taxable income.

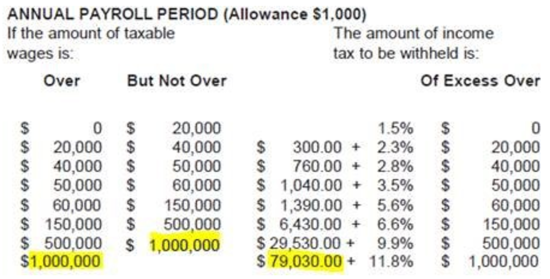

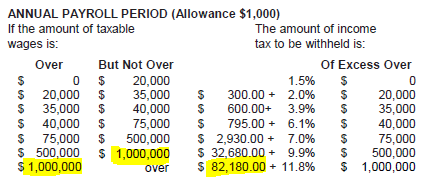

Oregon has four marginal tax brackets ranging from 5 the lowest Oregon tax. 2020 Tax Rate 475 675 875 99 Single and Separate 3600 3600 - 9050 9050-125000 125000 Joint and Head-of-Household 7200 7200 - 18100 18100-250000. The 2022 payroll tax schedule is a modest shift down from.

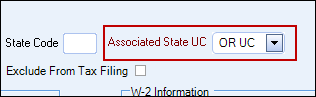

Tax rate of 99 on taxable income over 125000. Oregon workers are subject to Workers Benefit Fund WBF assessment tax. Part-year resident and nonresident Form OR-40-P and Form OR-40-N filers.

Use e-Signature Secure Your Files. If there are any problems here are some of our. For married taxpayers living and working in the state of Oregon.

Oregons tax brackets are indexed for inflation and are updated yearly to reflect changes in cost of living. If there are any problems here are some of our. The combination of the changes to all of the workers compensation rates for 2020 will result in the average employer paying 102 per 100 of payroll for claims costs and assessments.

Go to Oregon Wbf 2020 Rate website using the links below. Full-year resident Form OR -40 filers. The detailed information for Oregon Wbf Assessment Rate 2020 is provided.

84 percent decrease 2019. To help offset high. Unemployment tax rates for employers subject to Oregon payroll tax will move to tax schedule three for the 2022 calendar year.

Go to Oregon Wbf 2020 Rate website using the links below. Enter your Username and Password and click on Log In. Enter your Username and Password and click on Log In.

The 2022 Workers Benefit Fund WBF assessment rate is 22 cents per hour. 97 percent decrease Premium assessment State regulatory costs to administer workers compensation and workplace safety programs. If there are any problems here are some of our.

Tax brackets for earnings under under 125000 are indexed for inflation and adjusted yearly while tax brackets over 125000 are only changed explicitly by statute. Upload Modify or Create Forms. The oregon 2021 state unemployment insurance sui tax rates range from 12 to 54 on rate schedule iv up from 07 to 54 on rate schedule ii for 2020 and 09 to 54 on rate.

2021 tax y ear rates and tables. Help users access the login page while offering essential notes during the login process. Complete Edit or Print Tax Forms Instantly.

The Workers Benefit Fund WBF assessment funds return-to-work programs provides increased benefits over time for workers who are permanently and totally disabled and gives benefits to. Enter your Username and Password and click on Log In.

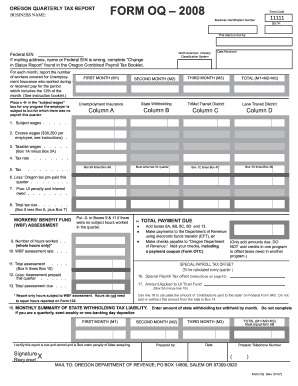

Oregon Workers Benefit Fund Payroll Tax

Mens Nike Air Force 1 Low Wbf World Basketball Festival Pack China Size 9 Yellow Ebay

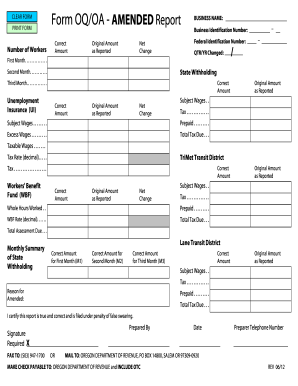

Or Dor Oq Oa 2012 2022 Fill Out Tax Template Online

Oregon Oq Form 2020 Fill And Sign Printable Template Online

Oregon Business Development Department State Of Oregon

Study Shows Multnomah County Will Have Nation S Highest Income Taxes For High Income Earners If Preschool Measure Passes

Oregon Payroll Tax And Registration Guide Peo Guide

Oregon Workers Benefit Fund Payroll Tax

Oregon Oq Report Fill Online Printable Fillable Blank Pdffiller

Oregon Workers Benefit Fund Payroll Tax

Department Of Consumer And Business Services Charts Oregon Workers Compensation Costs State Of Oregon

The Gaming And Decline Of Oregon Corporate Taxes Oregon Center For Public Policy

Oregon Workers Benefit Fund Wbf Assessment